By Foo Yu Lin, Audrey Li | 12 May 2021

Black Soldier Flies (BSF) have increasingly come into the spotlight for their potential in addressing several key global challenges: resource depletion and environmental degradation, food waste, and climate change. BSF solutions have the potential to drive a circular economy: the larvae convert organic and food waste into fertilizer, and are harvested as insect protein to replace unsustainable fish feed for aquaculture or crop-based animal feed for livestock. To top it all, black soldier fly farms require relatively small plots of land low quantities of water and have a low energy footprint.

The economic potential of the black soldier fly market is still small but expected to see dramatic growth in the coming years. The global market was worth US$ 128 million in 2019, but projected to reach $3.4 billion by 2030. Moreover, Asia Pacific accounted for the largest share of the global market in 2019, both in terms of value (~50%) and volume (57.1%). With an increasing global population and demand for meat and seafood, a growing aquaculture industry along with rising prices of fish meal and animal feed, as well as the rising awareness of sustainability issues, the popularity of these insects is set to grow.

Some Biology: Understanding the Black Soldier Fly

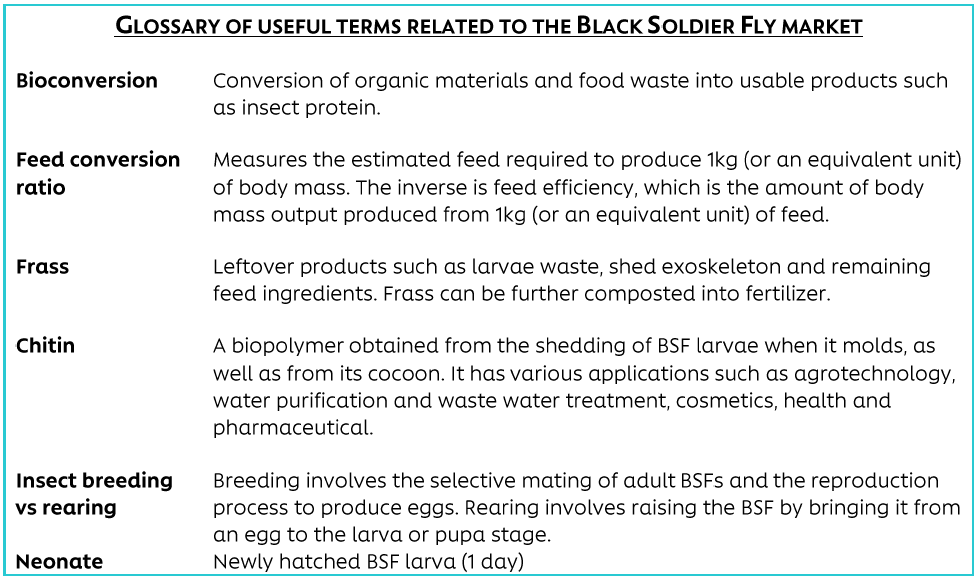

Found in tropical and subtropical regions, the Black Soldier Fly, or Hermetia illucens, has a life cycle that spans around 5 to 6 weeks. The feeding larva is usually the main agent for waste management and bioconversion of organic waste into protein, which is then harvested.

Figure 1: Life cycle of a commercial BSF (Image source: Wiki Commons, FreezeM)

Commercializing BSF farming for waste bioconversion and biomass production

In commercial facilities, the larvae feed on a substrate that comprises a mix of organic materials or food waste. Research have found that BSF larvae are able to consume and reduce the amount of substrate (and hence waste), with material degradation of up to 50 -70%, while simultaneously emitting less greenhouse gases than other composting methods. Depending on the type of substrate, the feed conversion rate (FCR) ranges between 1.7 and 3.6 (i.e., 1.7kg to 3.6kg of food waste produces 1kg of BSF larvae protein). A study found that 190 kg of food waste was used to produce 79 kg of BSF larvae. From a nutrition perspective, BSF are high in protein and fat content, comprising on average 42.1% protein and 38.4% fat. The figure below illustrates a typical production process.

Figure 2: BSF bioconversion and biomass production process (modified from Mertenat et al., 2019 and Eawag Aquatic Research)

Scaling up this process presents a promising avenue for organic waste reduction and environmental sanitation, and food waste valorization into useful products including:

Protein powder for animal feed (pet food, livestock and aquaculture feed) and even alternative protein for human consumption

Frass for fertilizer production

Oil for biodiesel, cosmetics or pharmaceuticals

Insect chitin for biomaterial inputs

A rapidly growing space and emerging solutions

To tap into these market opportunities, various solutions and stakeholders have emerged along the value chain from BSF farmers to technology and services supporting BSF production. Due to the multiple applications of BSF, most companies offer diversified solutions and hence serve more than one submarket type identified in Figure 2. For example, FlyFarm provides waste management services and also sells protein feed. Furthermore, some BSF farms that have developed their own farm management technology also offer their technology as a service to other farms – for example, Protenga employs its data-driven smart farming technology to produce aquafeed, and also leases its technology to other farms.

Figure 3: Examples of Black Soldier Fly companies (largely focused on Asia)

In general, it appears that the Southeast Asia region has the fastest growing BSF protein-based aquafeed market, while the BSF market in China tends to focus relatively more on waste management. There is also a rise in technology and service providers, although the majority of the solutions in this segment are based in Europe and the USA.

Key challenges and opportunities in China and Southeast Asia

1. Waste management services

BSF farms typically procure and prepare the organic waste stream inputs by themselves. However, there is a lack of waste segregation practices and organic waste regulations in Southeast Asia, which is necessary since BSF waste source must be fully organic. Input procurement is consequently more complex, which calls for the need for infrastructure, logistics and regulatory interventions.

Although China has organic waste regulations in place, the growing demand for waste management services exceeds the supply of insect-based waste solutions, meaning that the BSF sector has the right market conditions for the industry to grow. In order to scale and meet the growing market demand, a key challenge Chinese BSF companies will need to resolve is the high capital investment (especially for at-scale production): in one case study, in order to process 30 tons of organic waste, the initial investment can reach CNY 15 million. The highest cost drivers are warehouse construction costs and machinery investment for large-scale automated production.

2. BSF farm production

Currently, many BSF farms in Asia face the challenge of scaling up their production to an industrial scale to compete with existing animal feed suppliers. One underlying reason is that most existing information used to develop industrial production are based on laboratory-level studies, and thus it is challenging to determine how the findings will and should be applied on a much larger scale. Some BSF farms are also relatively labor-intensive. Other challenges include ‘engineering’ the breeding process via ensuring good quality brood stock, and controlling the environment for adult flies to breed in sufficient quantities while producing quality eggs, building up farm infrastructure for expansion, and meeting consistent product standards. However, companies that leverage a strong in-house research and development team, as well as farming technology are rapidly growing and attracting investments in the region.

3. Farm management technology and services

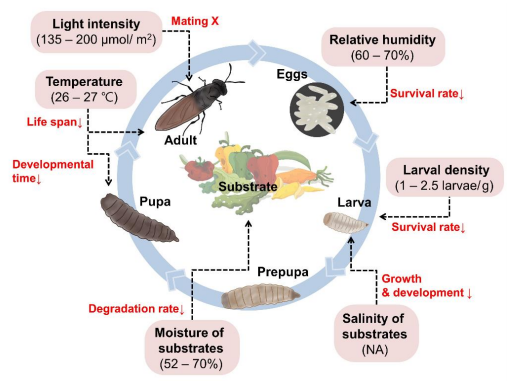

Environmental control for rearing BSF is a crucial challenge and opportunity for service providers to develop a value proposition. Smart farming technology and services have sprung up to improve the efficiency of BSF farming. Many of these tend to revolve around environmental and IoT data monitoring, which is useful in attaining the optimal conditions for BSF development throughout its lifecycle (Figure 3). This might be valuable to smaller-scale companies without the in-house expertise or resources to develop their own technology. Most Southeast Asian countries have a tropical climate with high temperatures and humidity, which is generally conducive for farming black soldier flies throughout the year. In comparison, China experiences a range of climatic conditions across the country (although in general the weather in many provinces is much colder and drier) and changing seasons, thus requiring more intervention for climatic control of BSF farming facilities. Such interventions come with its own set of challenges as the technology for large-scale breeding in such environments is still nascent and there is space for further development, and by extension an area worth exploring for investors moving into this market segment.

Figure 4: Optimal factors that directly affect black soldier fly larvae growth; consequences of suboptimal conditions are shown in red (Kim et al. 2021)

4. Outsourcing of breeding

The rise of egg production and breeding biotechnology solutions show a trend towards specialization in the market. Ready-to-use egg suppliers enable BSF farms and factories to outsource the breeding process for a few reasons. Firstly, farms may save on the space required to set up a hatching and breeding facility, and cut down on the time, skilled manpower and costs required to operate this process. Secondly, farms can also acquire a steadier stream of starting stock for their operations. This is particularly useful for waste management companies, as a steady mass production of small larvae is vital to waste treatment. The growth potential of BSF egg suppliers will depend on the extent to which BSF farmers perceive outsourcing as a way of de-risking their operations, improved unit cost economics and profit margins, as well as the quality of eggs and efficiency gains.

From an impact angle, the black soldier fly market has huge potential in addressing various sustainability issues: reducing the amount of food waste that goes to landfills; serving as a sustainable fertilizer; and producing animal or aquaculture feed where in case of the latter, it serves to reduce the amount of wild caught fish from an already overfished global stock. However, black soldier fly companies are not necessarily sustainable by virtue of being in this industry; farming and production at commercial scales will require energy and resource inputs, and generate emissions. Thus, they should be evaluated through environmental impact assessments on a company level. As with other agriculture production sectors, the excessive monoculture of BSF and the potential biodiversity or environmental backlashes should be considered. Lastly, while the case for using BSF as feed has been rather developed, further research should be conducted to explore the potential of BSF as a protein alternative for human consumption.

References

Meticulous Research. 2021. Black Soldier Fly (BSF) Market to Reach $3.4 Billion by 2030- Exclusive Report Covering Pre and Post COVID-19 Market Analysis and Forecasts by Meticulous Research. (Link)

Lalander, Cecilia H. et al. 2014. “High Waste-to-Biomass Conversion and Efficient Salmonella Spp. Reduction Using Black Soldier Fly for Waste Recycling.” Agronomy for Sustainable Development, 35 (1), 261–271. (Link).

Kim, Chul-Hwan et al. 2021. “Use of Black Soldier Fly Larvae for Food Waste Treatment and Energy Production in Asian Countries: A Review.” Processes. 2021; 9(1):161. (Link)

Gligorescu, Anton et al. 2020. Production and Optimization of Hermetia illucens (L.) Larvae Reared on Food Waste and Utilized as Feed Ingredient. Sustainability. 2020; 12(23):9864. (Link)

Yang, Fangchun and Tomberlin, Jeffery K. 2020. Comparing Selected Life-History Traits of Black Soldier Fly (Diptera: Stratiomyidae) Larvae Produced in Industrial and Bench-Top-Sized Containers. Journal of Insect Science, 20 (5), 25. (Link)

Tencent, 2021. China Science News: Black soldier flies and a trillion-dollar industry. (Website)

The Central Committee of the Jiu San Society. 2020. (Website)

Joosten, Lotte et al. (2020). Review of Insect Pathogen risks for the black soldier fly (Hermetia Illucens) and guidelines for reliable production. Entomologia Experimentalis Et Applicata, 168(6-7), 432-447. (Link)

Singh, Anshika, and Kanchan Kumari. “An Inclusive Approach for Organic Waste Treatment and Valorisation using Black Soldier Fly Larvae: A Review.” Journal of Environmental Management, 251, 109569. (Link)

Carusco, Demenico et al. 2013. Technical handbook of domestication and production of diptera Black Soldier Fly (BSF) Hermetia illucens, Stratiomyidae. (Link)

Comentarios